- What is customs clearance, Meaning and Process

- Why Your Package Stuck in Customs

- What does customs clearance completed mean

- How long does customs clearance take?

- How To Avoid Paying Customs fees And Import Duty Through Nihaojewelry(customs clearance Guide)?

- FAQ

- In Summary

Complicated customs clearance has always been a major problem for buyers and sellers alike.

Especially when importing goods from China.

It is important to understand the process to avoid unnecessary customs fees and import duties.

If you run a jewelry business and want to reduce or avoid customs duties, please read on carefully.

Following these guidelines allows you to go through the customs process smoothly and minimize your expenses.

This last point is important.

What is customs clearance, Meaning and Process

Customs clearance is a crucial part of the import process.

Before we delve into strategies to minimize customs fees, it’s important to understand what these costs entail and how customs clearance works.

Meaning of Customs Clearance

Customs clearance is a mandatory procedure for all goods entering or leaving a country.

The process begins when the shipment arrives at customs in the importing country. The customs authority then checks the documents and inspects the goods.

A customs declaration must be completed (this is usually done by a customs broker), which contains important information about the goods being imported into or leaving the country.

If the customs declaration meets the requirements of the customs authority, it is approved.

In this case, the goods are cleared through customs and can cross the border after payment of the required expenses.

If the declaration does not meet the requirements of the customs authority, further information or an inspection of the goods may be requested.

In this case, the goods will be detained at the border until the declaration meets the requirements.

Here are Customs Fees and Import Duty:

- Customs Fees: These are fees charged by the customs authorities for processing your import declaration.

- Import Duty: This is a tax levied on imported goods based on their value and classification.

Process of Customs Clearance

Customs clearance involves multiple steps and procedures, including:

- Documentation – The importer or exporter must provide the necessary documents.

- Customs Declaration – The importer or exporter must submit a customs declaration form that provides detailed information about the shipment, such as the nature of the goods, their value, quantity, country of origin, and intended use.

- Examination and Inspection – Customs authorities may conduct physical inspections, x-ray screenings, or laboratory testing of the goods to verify the provided customs declaration information and ensure compliance with all regulations.

- Duty and Tax Assessment – Customs authorities assess the applicable duties, taxes, and fees, based on the classification and value of the goods.

- Payment and Clearance – The importer is responsible for paying the duties, taxes, and fees. Once payment is made, customs authorities issue a customs clearance certificate or release order, and goods can proceed to their final destination.

Essential Documents for Customs Clearance:

- Custom invoice: It includes information like the description of goods, prices, and terms of sale.

- Packing List: It includes information like the number of packages, the contents of each package, and the weight and measurements.

- Bill of Lading: It serves as a receipt for the goods and evidence of the contract of carriage.

Why Your Package Stuck in Customs

Having a package stuck in customs can be very annoying. To fix the problem, it’s important to know why customs is holding your package.

- Missing or Incorrect Documentation: Incomplete or inaccurate customs forms: Ensure all required information is filled out correctly.

- Prohibited or Restricted Items: Check the import regulations of your country to ensure the items in your package are allowed.

- Outstanding fees & taxes: If the required import duties or taxes are not paid, your package may be held until the payment is made.

- Shipping Carrier Issues: Sometimes, shipping carriers may experience delays or make mistakes that can affect the delivery of your package.

Attention:

Most countries will charge you import duties and taxes for shipments that exceed a certain value.

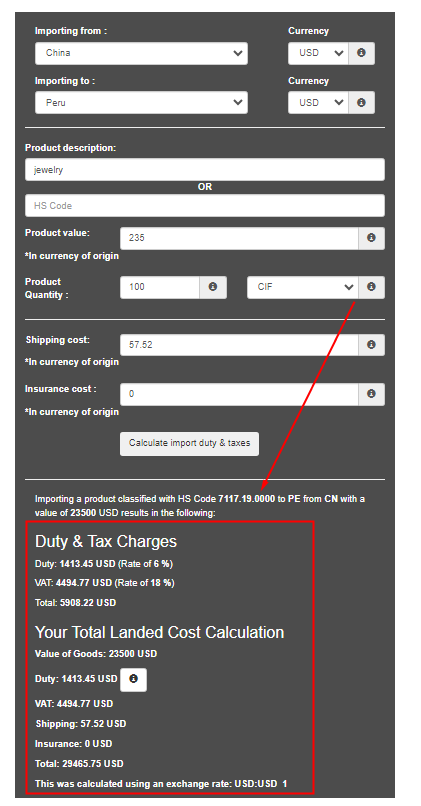

Additionally, you can use the import duty calculator: SimplyDuty, to estimate the tax amount you will have to pay.

What to Do if Your Package is Stuck in Customs

- First, not all customs holds happen because of bad products. In many countries, the customs process usually takes time. It can take several days to finish.

- Contact the Shipping Carrier: Reach out to the shipping carrier for an update on your package’s status and to inquire about any potential issues.

- Check Customs Regulations: Review your country’s import regulations to ensure compliance.

- Provide Missing Information: If requested, provide any missing or incorrect documentation to customs authorities.

- Pay Outstanding Duties or Taxes: If applicable, pay any outstanding import duties or taxes to release your package.

What does customs clearance completed mean

After taxes and duties are paid and all papers are checked, the parcel can be cleared.

This means it can be sent to its final place.

The parcel is then handed over to the local postal service.

Now, the parcel is ready to be delivered to the person who ordered it.

How long does customs clearance take?

The time it takes for Customs clearance can change based on different things.

These include the country, the customs rules, how many shipments there are, and any problems or checks that might come up.

Usually, customs clearance can take a few hours to a few days, and sometimes even weeks.

To get a better idea of the time needed for your case, talk to local customs officials or shipping agents.

For more related answers check here.

How To Avoid Paying Customs fees And Import Duty Through Nihaojewelry(customs clearance Guide)?

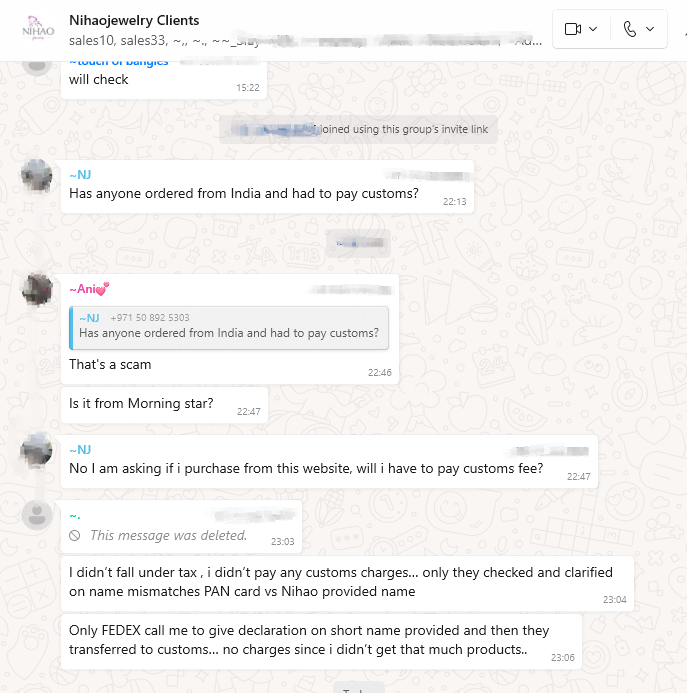

Contact your account manager

Contact your account manager to make low-value declarations on purchased products to reduce tariffs.

Ask your account manager any questions you have!

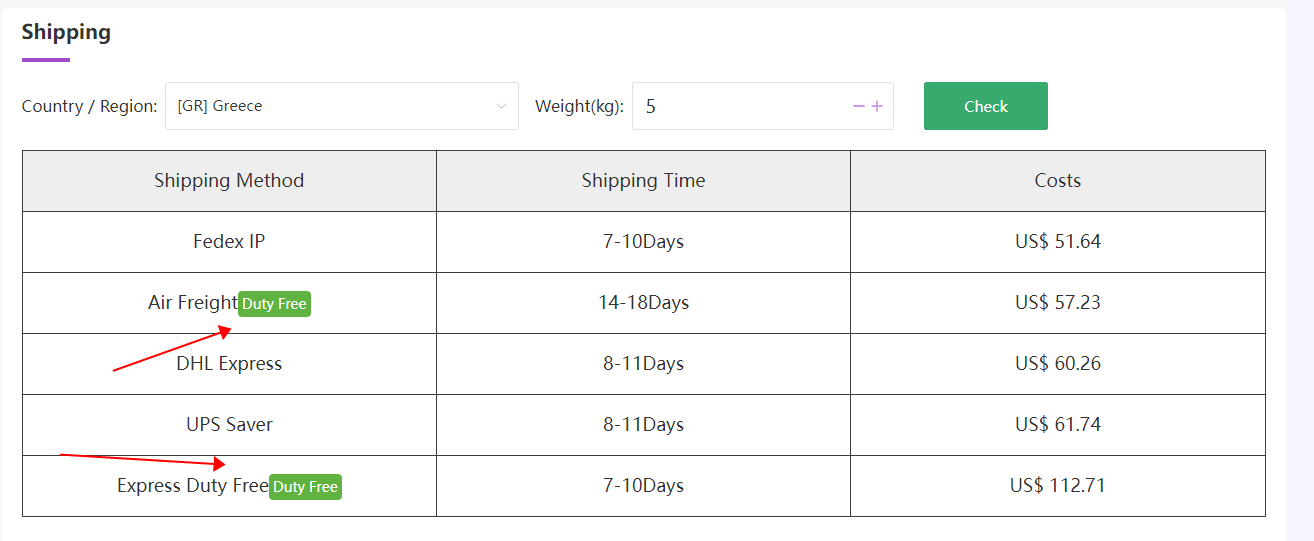

Choose package customs clearance logistics channel

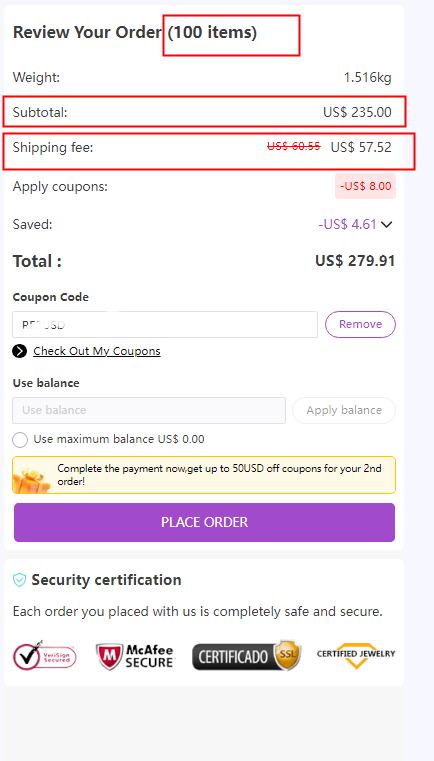

Shipping terms and costs play a significant role in the total cost of importing goods from China.

However, the starting point of duties and exemptions are different for each country and region, depending on the customs legislation of your country.

Therefore, you should always optimize your shipping costs. Keep an eye on your budget, the items you want to buy, and the shipping costs for each kilo.

In this way, the cost of his purchases will always be reasonable and you will be able to make a good profit after paying taxes.

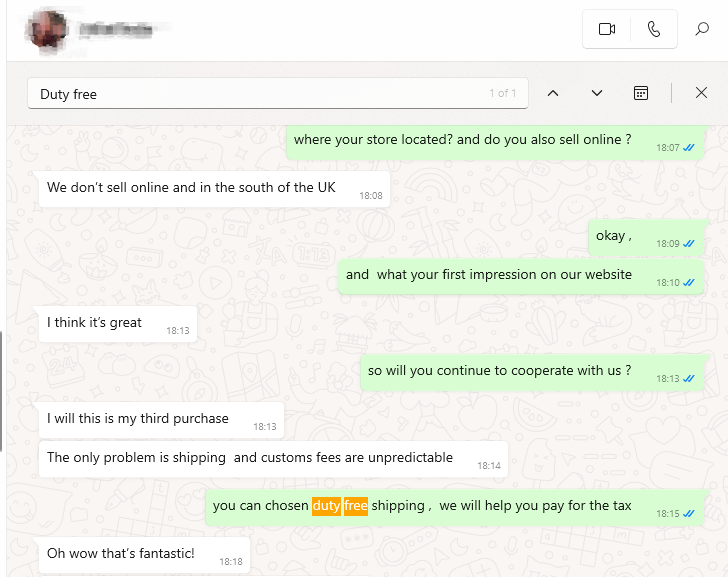

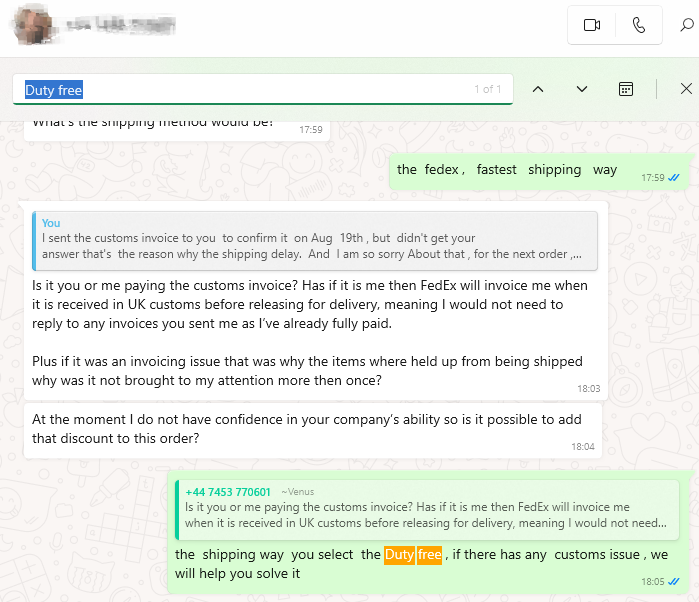

For some countries and regions (e.g. Mexico, Costa Rica, Colombia, United Kingdom, France, Germany, Greece, etc.), Nihaojewelry provides tax-paid channels, that is, the logistics channel name contains the word ‘Duty Free‘ included.

If you choose these channels, if you incur fees, you can pay them first and then contact your advisor with proof of payment for a refund.

FAQ

No, you don’t need one. But you can work with either an independent customs broker or customs brokerage firm.

If you are sending goods from the United States, you have to pay import duties. For more information, contact your local customs office.

Yes, Customs can hold a shipment even if it has cleared if the documentation contains mistakes or is missing critical information.

In Summary

Navigating customs fees and import duties when importing from China can be complex.

However, with the right knowledge and strategies, it’s possible to minimize these costs.

By following the advice in this guide, you can make the import process smoother and more cost-effective.

Contact me for more information.